Why Your Retirement Plan Needs a Stress Test (And How to Run One in 60 Seconds)

The simple truth most financial calculators won't tell you—and what Wall Street uses instead

You've saved diligently for decades. You've run the numbers a hundred times. Your spreadsheet says you're good through age 95, assuming 7% annual returns and your expenses stay exactly as planned.

Here's the uncomfortable question: What happens when the market doesn't cooperate?

What if you retire right before a crash like 2008? What if inflation spikes the way it did in 2022? What if healthcare costs double in your seventies? What if you live to 100 instead of 95?

Your retirement plan isn't a math problem with one right answer. It's a probability game played across decades of market chaos, unexpected expenses, and life throwing curveballs. And if you're only planning for the best-case scenario, you're not actually planning at all.

The Straight-Line Illusion (And Why It's Dangerous)

Most retirement calculators work like this: you enter your savings, assume a steady return (usually 7%), subtract your annual spending, and watch the line march predictably upward for 30 years.

It looks reassuring. It feels scientific. And it's completely divorced from reality.

The stock market doesn't deliver 7% every year. It delivers +32% one year, -18% the next, +14% after that, then -4%, then +22%. Over decades, those returns might average 7%, but the sequence matters enormously.

Retire into a bull market? You're golden.

Retire into a bear market? Your nest egg might not recover.

This is called sequence-of-returns risk, and it's the reason that two retirees with identical savings, identical spending, and identical average returns can have completely different outcomes based solely on when they retired.

According to research from the Stanford Center on Longevity, retirees who experienced significant market downturns in their first decade of retirement had a 40% higher risk of depleting their portfolios compared to those who retired during stable or bull markets—even when their long-term average returns were the same.

The straight-line calculator can't account for this. It assumes the market plays nice. And the market never plays nice.

What Wall Street Uses Instead: Monte Carlo Simulation

When institutional investors and professional financial advisors need to model retirement outcomes, they don't use straight-line calculators. They use something far more sophisticated: Monte Carlo simulation.

Here's how it works:

Instead of assuming one perfect scenario, Monte Carlo modeling runs thousands of different scenarios simultaneously—each one using actual historical market data to simulate what could happen. Some scenarios include crashes. Some include boom years. Some include inflation spikes. Some assume you live to 85. Others to 102.

Then it shows you: What's the probability your plan succeeds across all these possibilities?

Not "will it work?" but "how likely is it to work?"

That's the difference between false confidence and actual preparedness.

The Financial Planning Association research on retirement modeling demonstrates that advisors using Monte Carlo analysis identify portfolio vulnerabilities that traditional calculators miss in over 60% of cases. It's the difference between hoping your plan works and knowing the odds.

The Problem: Monte Carlo Used to Cost You

For years, Monte Carlo modeling was locked behind expensive financial advisor software or subscription services charging $50-$200 annually. If you wanted professional-grade retirement analysis, you either paid someone hundreds of dollars per hour or subscribed to platforms designed for institutions, not individuals.

But here's what nobody was saying: the math isn't proprietary. The data isn't secret. The modeling techniques are well-established.

The barrier wasn't the technology—it was access. Financial services companies were gatekeeping tools that should have been available to everyone planning retirement.

That's exactly why I built Retirement Success Graph.

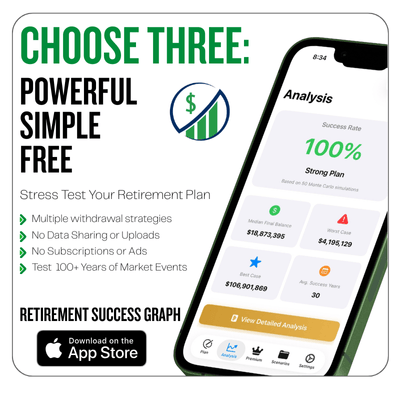

A Professional Tool Without the Professional Price Tag

Retirement Success Graph is an iOS app that brings institutional-grade Monte Carlo modeling to your phone. No subscriptions. No hidden fees. No compromises on privacy or capability.

Here's what makes it different:

Industry-Proven Statistical Modeling

The app uses the same Monte Carlo methodology trusted by financial advisors and institutional investors—running your retirement plan through thousands of different economic scenarios based on over 100 years of actual market data.

50 Free Simulations for Everyone

From the moment you download the app, you get full access to professional-grade analysis. Run 50 simultaneous simulations to stress-test your retirement plan against market volatility, inflation variations, and different life expectancies through age 95.

10,000 Simulations for $5 (One-Time)

Want exponentially more powerful predictive modeling? Unlock all premium features with a single $5 purchase. No subscriptions. No annual fees. Just a one-time upgrade that gives you access to:

- 10,000 simultaneous scenario calculations

- Multiple withdrawal strategies (Dynamic, Bucket Strategy, Bond Ladder, and more)

- Social Security claiming optimization for different ages and spousal strategies

- Variable expense modeling (increased travel spending, healthcare costs, downsizing)

- One-time events (inheritances, windfalls, major purchases)

- Recurring income from pensions, annuities, or part-time work

- Exportable results you can save or share with advisors

Mathematically, the app can process up to 10^1950 unique scenarios—a number so astronomically large it would take 33 minutes just to write out the zeros. That's the power of professional-grade retirement modeling, accessible for less than the cost of lunch.

Privacy by Design (Because Your Data Is Yours)

Here's what most retirement planning tools don't tell you: when you enter your financial information on websites or cloud-based platforms, your data is stored on their servers. They know your savings. They know your spending. They know your retirement plans.

And often, they're selling that data to advertisers, insurance companies, or financial services firms looking for leads.

Retirement Success Graph takes the opposite approach: All calculations happen on your device. Your financial information never leaves your phone. There's no cloud storage. No account creation. No login required. Nothing is ever transmitted to servers or shared with third parties.

You get professional analysis without compromising your privacy. No ads. No data harvesting. No registration. Just you and your retirement plan.

How It Actually Works (Interview Mode for Beginners)

Never modeled a retirement plan before? The app includes Interview Mode—a guided experience that walks you through creating your first retirement projection using simple questions:

- Current age and retirement age

- Current savings and expected contributions

- Expected annual spending in retirement

- Social Security estimates (if applicable)

- Investment allocation and risk tolerance

Answer the questions in plain language, and the app translates your inputs into a comprehensive retirement model.

Already know what you're doing? Skip straight to the advanced inputs and model multiple scenarios side-by-side.

What-If Analysis (Because Plans Change)

Life doesn't follow your spreadsheet. Maybe you want to model:

- Retiring three years earlier than planned

- Buying a vacation home in your sixties

- Increasing travel spending in your active years

- Healthcare costs doubling in your eighties

- Leaving an inheritance for your children

The app lets you instantly compare different scenarios to see how small changes impact your long-term success probability. Want to know if you can afford to spend an extra $20,000 on travel each year for the next decade? Run the simulation and see the actual impact on your plan's viability.

According to research from the Employee Benefit Research Institute, retirees who actively model different spending scenarios report significantly higher confidence in their financial decisions compared to those using static projections.

The 4% Rule (And Why It's Not Enough)

You've probably heard of the 4% rule: withdraw 4% of your portfolio annually, adjust for inflation, and your money should last 30 years.

It's a useful starting point. It's also potentially catastrophic if applied blindly.

The 4% rule was based on historical data and assumes certain market conditions, portfolio allocations, and spending patterns. But what if your circumstances differ? What if you retire at 50 instead of 65? What if you need to withdraw 5% some years and 3% others? What if your portfolio isn't 60/40 stocks/bonds?

Retirement Success Graph validates whether the 4% rule actually works for YOUR specific situation—or if you need to adjust. It models multiple withdrawal strategies (constant percentage, dynamic spending, bucket strategies, bond ladders) and shows you which approach gives you the highest probability of success.

The MIT AgeLab research on retirement spending demonstrates that retirees using adaptive withdrawal strategies based on market performance and portfolio values have significantly better long-term outcomes than those rigidly adhering to fixed percentages regardless of conditions.

Social Security Optimization (The $100,000+ Decision)

When you claim Social Security can be one of the most valuable financial decisions of your retirement—potentially worth over $100,000 in lifetime benefits depending on your claiming age, life expectancy, and spousal situation.

Claim at 62? Your benefits are permanently reduced by up to 30%.

Wait until 70? Your benefits increase by 8% per year after full retirement age.

Married? Spousal strategies and survivor benefits add additional complexity.

The premium version of Retirement Success Graph lets you model different Social Security claiming strategies to see which approach maximizes your long-term financial security based on your specific portfolio, spending needs, and life expectancy.

Real Results in Real Time

Here's what happens when you actually use the app:

You enter your information. You hit "Run Simulation." And within seconds, you see:

Your Success Probability: What percentage of scenarios result in your money lasting through age 95?

Interactive Portfolio Trajectories: Visual charts showing how your portfolio could perform across different economic conditions—best case, worst case, and everything in between.

Year-by-Year Projections: See exactly when your portfolio might face stress and how different decisions impact long-term viability.

Comparison Analysis: Run multiple scenarios side-by-side to make informed decisions about spending, withdrawal rates, or retirement timing.

No waiting for an advisor appointment. No paying hundreds for a financial plan. Just instant, professional-grade analysis whenever you need it.

Who This Is For

Retirement Success Graph is designed for:

- Early retirees and FIRE pursuers (ages 40-60) who need sophisticated modeling for 30-40+ year retirement horizons

- Soon-to-retire professionals (ages 55-65) validating their plans before making the final leap

- Current retirees stress-testing their withdrawal strategies and spending decisions

- Anyone planning for financial independence who wants institutional-quality analysis without institutional costs

Whether you're three decades from retirement or three months, the app gives you the confidence to make informed decisions.

Download and Get Started (It Takes 60 Seconds)

The free version is fully functional. Download it today and run your first Monte Carlo analysis. See how your retirement plan performs across 50 different economic scenarios. Validate your strategy. Identify vulnerabilities. Gain confidence.

Want the full power? Upgrade once for $5—no subscriptions, no recurring fees—and unlock 10,000 simulations, Social Security optimization, variable expense modeling, and every premium feature.

Your retirement is too important to guess. Stop using calculators that assume perfection. Start using the same modeling techniques Wall Street trusts.

Download Retirement Success Graph from the App Store →

The Bottom Line

You've spent decades building your retirement nest egg. You deserve to know—with actual statistical confidence—whether your plan will work.

Not hope. Not wishful thinking. Not straight-line assumptions that ignore market reality.

Real analysis. Real probabilities. Real confidence.

That's what Monte Carlo modeling provides. And now you can access it for free on your phone.

Get started now at retirementsuccessapp.com →

Want more retirement planning insights? Subscribe to the Casual Mondays Podcast for weekly conversations about designing meaningful post-career lives. No financial jargon. No sales pitches. Just honest guidance for those who've traded their suit for sandals and their desk for a deck chair.