This Isn't One Chapter—It's Multiple Books: Planning for 30+ Years of Evolution

When you started your career, nobody handed you a 40-year plan. You had a rough direction, some initial goals, and you adapted as circumstances changed.

Yet retirement planning often assumes you'll do the same things for 30+ years: travel, golf, hobbies, grandchildren. As if retirement is one monolithic phase rather than multiple distinct chapters.

The reality? Retirement at 55 looks nothing like retirement at 65, which looks nothing like retirement at 75, which looks nothing like retirement at 85.

Your energy shifts. Your interests evolve. Your capabilities change. Your priorities transform. Family needs fluctuate. Health realities emerge.

Treating all this as "retirement" is like treating ages 25-65 as "working years" without recognizing that your 30s, 40s, and 50s each brought different focuses, challenges, and opportunities.

The five-year vision framework recognizes that retirement isn't one destination—it's a series of stages requiring different strategies, priorities, and adaptations.

Why the Traditional Retirement Model Fails

Traditional retirement planning makes two fatal assumptions:

Assumption 1: Retirement is linear decline

The model assumes steady, gradual decrease in capability, activity, and engagement. This maps to reality for maybe the final 5-10 years—but ignores that many retirees are more active, engaged, and capable at 70 than they were at 55 when still grinding through career exhaustion.

Assumption 2: One plan fits all years

Financial planning treats retirement as single phase: "You'll spend $X annually for 30 years." But spending patterns vary dramatically across retirement—higher travel spending in early active years, lower discretionary spending in middle maintenance years, potentially higher healthcare spending in later years.

Research from the National Institute on Aging on retirement life phases shows that successful retirees recognize and plan for distinct stages, adjusting goals and strategies as they transition between them.

The Five Retirement Phases

While everyone's timeline varies, retirement generally progresses through five phases:

Phase 1: Liberation (Years 1-3)

Fresh out of career, energy high, sense of freedom, desire to do everything postponed during working years. This is when bucket lists get aggressively pursued, when retirees overcommit to activities, when travel peaks.

Psychological state: Relief mixed with identity confusion

Primary challenge: Adjusting to unstructured time without career definition

Financial pattern: Often higher spending as delayed gratification releases

Optimal focus: Experimentation—trying activities, exploring options, discovering what retirement means to you

Phase 2: Recalibration (Years 4-10)

Initial excitement settles, you've tried enough to know what you actually enjoy versus what sounded good, beginning to build sustainable retirement rhythms rather than reacting to newfound freedom.

Psychological state: Finding authentic groove

Primary challenge: Creating sustainable meaning beyond initial novelty

Financial pattern: Spending often moderates as you stop pursuing everything

Optimal focus: Building sustainable routines, deepening relationships, developing expertise in areas that genuinely engage you

Phase 3: Contribution (Years 11-20)

Many retirees feel drawn to mentoring, volunteering, teaching—sharing accumulated wisdom while still having energy and capability. This is when "giving back" becomes central rather than peripheral.

Psychological state: Generative, focused on legacy

Primary challenge: Balancing contribution with self-care

Financial pattern: Often most stable phase—routines established, health still good

Optimal focus: Strategic contribution leveraging expertise, deepening select relationships, pursuing mastery in chosen domains

Phase 4: Preservation (Years 21-28)

Energy declining, health concerns emerging, focus shifting from growth to maintenance. Still independent but more selective about activities. Quality over quantity.

Psychological state: Contentment mixed with awareness of limitations

Primary challenge: Accepting reduced capability without losing engagement

Financial pattern: Medical expenses rising, activity expenses often declining

Optimal focus: Protecting independence, maintaining essential relationships, savoring simple pleasures

Phase 5: Adaptation (Years 29+)

Significant assistance may be needed, activities heavily constrained by physical limitations, focus on comfort and connection rather than achievement or experience.

Psychological state: Varies widely—acceptance, resistance, gratitude, fear

Primary challenge: Maintaining dignity and connection amid declining independence

Financial pattern: Potentially high medical/care expenses

Optimal focus: Quality of daily life, staying connected to people who matter, finding meaning in small moments

These aren't rigid categories—individuals progress through them at different rates or skip phases entirely. But recognizing the pattern helps you plan appropriately for each stage.

The Five-Year Planning Cycle

Given these distinct phases, long-term retirement planning requires flexibility. The five-year planning cycle provides structure without rigidity:

Every five years, ask:

1. What phase am I entering?

Energy levels, capabilities, interests, constraints—what's shifting as I move into this next five-year block?

2. What matters most in this phase?

Not what mattered last phase or what "should" matter. What actually resonates given current life stage?

3. What resources (time, energy, money) do I have?

Honest assessment of what's available—not what you wish you had or what you had five years ago.

4. How should I allocate resources?

Given what matters most and what you have available, how do you optimize this five-year block?

5. What needs to change from current patterns?

What worked last five years might not work next five. What should you add, remove, or modify?

This creates adaptive planning—adjusting to reality rather than rigidly pursuing plans made decades ago when circumstances were completely different.

Research from the Stanford Center on Longevity on the "New Map of Life" emphasizes that longevity requires we reimagine life stages entirely. Retirement isn't end of productive life—it's 30+ year period containing multiple sub-stages each with distinct characteristics and opportunities.

Planning Requires Financial Confidence Across Decades

Your retirement may span 30-40 years across multiple phases with varying financial demands. Model how your portfolio performs across these decades.

Retirement Success Graph uses Monte Carlo modeling to project success probability through different life phases. See how portfolio responds to varying spending patterns, healthcare costs, and market conditions across multiple decades.

The free version runs 50 simulations through age 95. Upgrade once for $4.99 to run 10,000 projections, model changing expenses across phases, and compare long-term strategies.

Your data stays private on your device. Download from the App Store and plan with confidence across retirement phases.

Flexibility Over Rigidity

The biggest mistake in retirement planning is creating rigid 30-year plan and viewing deviations as failures.

Life doesn't cooperate with plans:

- Health issues emerge unexpectedly

- Family situations change

- Interests evolve

- Opportunities appear

- Priorities shift

- Capabilities decline faster or slower than anticipated

The five-year vision approach accepts this reality. You're not locked into plans made at 55 when you're 75 and circumstances have dramatically changed. You're continuously adapting.

Flexibility requires:

Regular reassessment: Don't set-it-and-forget-it. Revisit plans, assumptions, priorities regularly.

Permission to pivot: Changing direction isn't failure—it's intelligent adaptation to new information.

Holding plans lightly: Plans are guides, not commitments. They inform decisions without constraining them.

Learning from experience: What worked? What didn't? Let evidence override assumptions.

The University of Michigan Health and Retirement Study longitudinal data tracking retirees across decades shows that adaptability—willingness to adjust plans as circumstances change—predicts satisfaction more than achieving specific goals set years prior.

The Active Years: Making the Most of Peak Freedom

The early retirement years (roughly first 10-15) represent peak freedom: enough health and energy for ambitious activities, minimal care responsibilities for aging parents or personal health, full control over schedule and priorities.

These years won't last forever. Making intentional use of them matters.

Strategic questions for active years:

What requires good health? Physical adventures, demanding travel, athletic pursuits—these have expiration dates. Don't defer them indefinitely assuming you'll "get to them later."

What relationships need investment now? Aging parents may not have 15 years. Grandchildren's formative years pass quickly. Friendships require cultivation while you have energy.

What learning deserves deep pursuit? Languages, instruments, physically demanding skills—easier to master with younger brain and body. Don't wait.

What risks are you willing to take? Career restart, entrepreneurship, major relocation—risk tolerance often decreases with age. If something appeals, sooner may be better.

The MacArthur Foundation Research Network on Successful Aging emphasizes that retirees who frontload demanding activities to earlier retirement years report higher lifetime satisfaction than those who defer them.

This doesn't mean frantically cramming everything into first five years—it means recognizing windows of opportunity and prioritizing accordingly.

The Middle Years: Sustainable Meaning

Roughly years 10-20 of retirement often bring shift from novelty-seeking to depth-building. The initial excitement of freedom has settled. You've tried enough to know what genuinely engages you versus what sounded appealing.

This is when many retirees find sustainable meaning through:

Deep expertise in select domains: Rather than dabbling in many things, developing genuine mastery in one or two areas.

Strategic contribution: Mentoring, teaching, volunteering—sharing accumulated wisdom while you still have energy and capability.

Relationship depth: Fewer but deeper connections. Quality over quantity in friendships and family engagement.

Routine rhythm: Structured patterns that provide satisfaction without feeling constraining.

These middle years often bring highest life satisfaction if navigated well. The confusion and adjustment of early retirement has passed. The physical limitations of later years haven't yet arrived. You're in the sweet spot—if you've built sustainable sources of meaning rather than relying on perpetual novelty.

The Later Years: Acceptance and Adaptation

Roughly years 20-30+ bring unavoidable realities: energy declines, health challenges emerge, activities become constrained, losses accumulate (spouse, friends, capabilities).

These years require different strategies than earlier phases:

Simplification: Reducing commitments, focusing on what truly matters, cutting obligations that drain more than fulfill.

Preservation: Protecting independence, maintaining essential capabilities, investing in health maintenance.

Savoring: Finding satisfaction in simple pleasures—daily walks, familiar routines, close relationships—rather than constant new experiences.

Legacy completion: Ensuring important relationships are tended, values are transmitted, affairs are organized for eventual transition.

Research from the AARP Public Policy Institute on retirement adaptation shows that successful aging in later retirement requires accepting limitations without surrendering engagement—a difficult balance many struggle with.

The retirees who navigate this phase best are those who:

- Accept decline without defining themselves by it

- Find meaning in reduced activity levels

- Maintain connections despite physical limitations

- Adapt goals to capabilities rather than mourning lost abilities

- Focus on quality of days rather than quantity of achievements

Planning for Cognitive Decline

The uncomfortable reality: cognitive decline affects many retirees eventually. Planning for this possibility while you're still cognitively sharp is responsible—however uncomfortable.

Practical steps:

Legal documents: Power of attorney, healthcare directives, living will—completed while you can make informed decisions.

Financial simplification: Reducing complexity so others can manage affairs if needed. Consolidating accounts, documenting systems, sharing information with trusted family.

Care preferences: Discussing with family what you want if/when significant assistance is needed. Home care vs. facility? Specific preferences for end-of-life? These conversations are difficult but essential.

Cognitive maintenance: The Harvard Medical School research on cognitive health shows that sustained intellectual engagement, physical exercise, social connection, and health management reduce dementia risk but don't eliminate it.

Monitoring systems: Regular cognitive assessments, trusted family monitoring for changes, early intervention if concerns emerge.

You may never experience significant cognitive decline. But planning for the possibility protects you and your family if it occurs.

Integration: Tying Season 1 Concepts Together

This final episode synthesizes all previous Season 1 concepts into comprehensive long-term vision:

Episode 1: Identity shifts across phases—who you are at 55 differs from 75. Continuous identity work across decades.

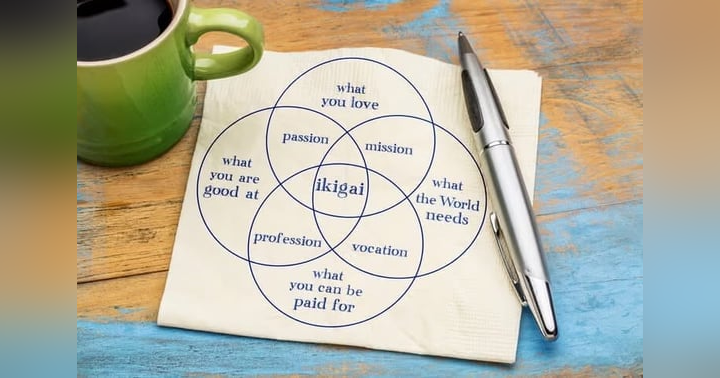

Episode 2: Purpose (Ikigai) evolves—your reason for being changes as capabilities and interests shift.

Episode 3: Structure needs vary—heavily structured in early adjustment, more fluid in middle years, simplified in later years.

Episode 4: Goals must adapt every five years—what mattered last phase may not matter next.

Episode 5: Social Connection requires different strategies across phases—building community early, deepening select relationships in middle years, maintaining essential connections later.

Episode 6: Health becomes increasingly central—preventive in early years, maintenance in middle, preservation in later.

Episode 7: Experiences shift from novelty to depth to simplicity across phases.

Episode 8: Work may be significant early, strategic middle years, abandoned in later years.

Episode 9: Relationships evolve—intensive family engagement early, peer friendships middle, essential connections later.

Episodes 10-11: Time and Money management changes dramatically as energy and capabilities shift.

Episode 12: Learning transitions from broad exploration to deep expertise to simple enjoyment.

Episode 13: Geography may change multiple times—active relocation early, stability middle, adaptation later.

Episode 14: Legacy building happens primarily in middle years with completion focus later.

Everything connects. Retirement isn't isolated activities—it's integrated life continuously adapting across decades.

The Gift of Time

If you retire at 55 and live to 85, you have 30 years. That's as long as your entire career. Enough time to reinvent yourself multiple times. Enough time to build deep expertise in new domains. Enough time to create meaningful legacy. Enough time to make mistakes and recover.

But only if you treat those 30 years as distinct phases requiring different strategies rather than one undifferentiated "retirement."

The five-year vision framework gives you:

- Structure without rigidity

- Direction without inflexibility

- Adaptation without directionlessness

- Continuity without stagnation

You reassess every five years, adjust to current reality, plan for the next phase, maintain long-term perspective while staying responsive to present circumstances.

Your Retirement, Your Design

This entire season has emphasized one theme: retirement is what you design it to be.

Not what it "should" be. Not what looks good to others. Not what retirement brochures depict. But what serves you—your values, interests, capabilities, circumstances.

You have 30+ years. Multiple phases. Countless opportunities. And complete freedom to design it all.

The question isn't "What does retirement look like?" It's "What do I want my next 30 years to look like, recognizing that those years will contain multiple distinct chapters each requiring different focus?"

Answer that question thoughtfully every five years, and you'll build a retirement that remains rich, meaningful, and adaptive across all the decades ahead.

Welcome to your next chapter. Actually, welcome to your next six or seven chapters—each one different, each one yours to design.

Ready to design your retirement decades? Listen to Episode 15 of Casual Mondays: "The Five-Year Vision - Designing Your Retirement Decades" wherever you get your podcasts.

Want to model your plan across multiple retirement phases? Download Retirement Success Graph to stress-test your strategy across decades—free from the App Store.