Portfolio Guilt: Why You Can't Bring Yourself to Spend the Money You Saved

You check your portfolio balance: $2.1 million. More than you ever imagined having. Enough to fund 30+ years of comfortable retirement according to every calculator you've run.

Yet when your spouse suggests upgrading to business class for your anniversary trip, you hesitate. "Is that really necessary? Economy is fine."

When your daughter mentions the kids need new winter coats, you offer to buy them. But when you need a new winter coat yourself, you keep wearing the one from 2015.

When friends invite you to an expensive restaurant, you suggest somewhere cheaper. "We don't need to spend that much."

You spent 40 years saving. Now you're supposed to spend. But that switch doesn't flip automatically just because you retired. The scarcity mindset that served you during accumulation years now undermines the freedom those years were supposed to create.

Welcome to portfolio guilt: the psychological inability to spend money you've saved even when spending is the entire point.

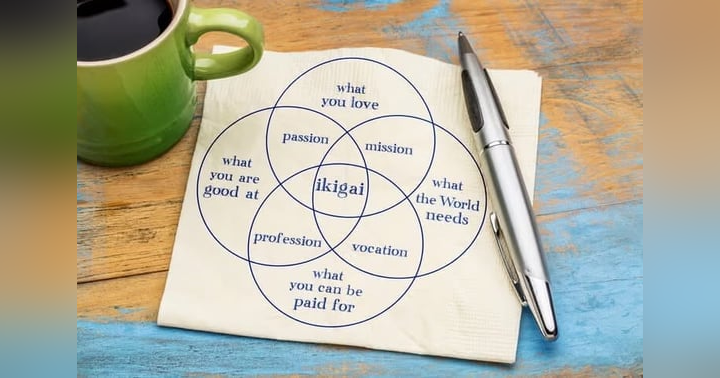

The Accumulation Mindset That Won't Let Go

For decades, your financial scoreboard was simple: net worth increasing = winning. Net worth decreasing = losing.

Every raise you invested rather than spent. Every bonus went to retirement accounts. Every windfall increased savings. Your identity as "good with money" was built on consistent accumulation.

This created deeply ingrained mental patterns:

- Spending = bad

- Saving = good

- Portfolio declining = failure

- Portfolio growing = success

These patterns don't evaporate the day you retire. Your brain has been trained for 40 years to maximize one metric—net worth growth. Suddenly you're supposed to optimize for a completely different metric: life satisfaction through strategic resource allocation.

That's not a switch. That's rewiring.

Research from the Employee Benefit Research Institute on retirement spending patterns shows that retirees consistently underspend their portfolios—not from financial necessity but from psychological inability to shift from accumulation to decumulation mindset. Many die with portfolios nearly as large as when they retired, having denied themselves experiences and quality of life they could easily afford.

You didn't save money to die with it. You saved it to use it. But using it requires overcoming decades of conditioning telling you that spending is failure.

The Permission-to-Spend Framework

If you're struggling to spend money you can afford to spend, you need to reframe what "good financial management" means in retirement.

Accumulation phase: Success = maximizing net worth growth

Decumulation phase: Success = maximizing life satisfaction per dollar

Notice the shift? You're no longer optimizing for highest number. You're optimizing for best life. Sometimes those align. Often they conflict.

Ask yourself: Would you rather:

- Die with $3 million having denied yourself experiences you could afford?

- Die with $1.5 million having fully funded a life rich in meaning, connection, and experience?

If you answer "the second one" intellectually but still can't bring yourself to spend, you're experiencing the gap between intellectual understanding and emotional permission.

Giving yourself permission to spend requires:

1. Defining "enough": What level of portfolio security actually satisfies you? If the answer is "more, always more," you'll never feel safe spending. Set a specific threshold: "When portfolio exceeds $X and projections show 90%+ success probability, I have permission to spend more freely."

2. Distinguishing strategic from frivolous: Not all spending is equivalent. Money spent on experiences creating lasting memories or relationships differs from money wasted on things you don't actually value. Strategic spending serves your priorities. Frivolous spending serves impulse or status. The first deserves permission. The second deserves scrutiny.

3. Recognizing time as the constraining resource: Your portfolio might last 40 years. Your health might not. Your energy might not. Your parents might not. Some experiences have expiration dates that money can't extend. Delaying certain spending isn't conservative—it's risking permanent loss of opportunity.

The University of Pennsylvania research on financial psychology in retirement demonstrates that retirees who establish clear spending permission frameworks report lower anxiety and higher life satisfaction than those operating on vague unease about whether spending is "okay."

Values-Based Spending: The Antidote to Guilt

Portfolio guilt often stems from spending without clear alignment to values. You feel bad about spending because you're not sure the spending actually matters to you—you're just spending because you can or because others suggest you should.

Values-based spending solves this by establishing clear criteria for what deserves funding:

Step 1: Identify your top 5 retirement values

Not what you should value. What you actually value. Examples:

- Family connection

- Health and vitality

- Learning and growth

- Adventure and travel

- Creative expression

- Comfort and security

- Generosity and legacy

- Freedom and autonomy

Step 2: Fund values ruthlessly, cut everything else mercilessly

If family connection is a top value, spending $5,000 on a multi-generational trip is strategic—even if it feels expensive. If status is not a value, spending $80,000 on a luxury car to impress neighbors is frivolous—even if you can afford it.

Values-based spending gives you permission to spend generously on what matters and ruthlessly cut what doesn't. The guilt disappears because every dollar has clear justification connected to your priorities.

Step 3: Measure spending by fulfillment, not price

A $10,000 experience that creates lifelong memories with your adult children might be a bargain. A $2,000 purchase that sits unused in your garage is expensive regardless of affordability.

Traditional budgeting optimizes for lowest cost. Values-based spending optimizes for highest return on fulfillment. Very different objectives.

The Paradox of Having Money But Fearing to Use It

The MIT AgeLab research on financial decision-making in older adults identifies a painful paradox: retirees often have the most wealth exactly when they're least willing to spend it.

This stems from:

Loss aversion intensifying with age: The psychological pain of loss exceeds the psychological pleasure of gain—and this asymmetry intensifies as you age. Spending $10,000 feels more painful than keeping $10,000 feels pleasurable.

Recency bias from market crashes: If you lived through 2008-2009, the memory of portfolio declining 40% creates permanent anxiety about "what if it happens again?" This causes over-conservative spending even when portfolio has fully recovered.

Ambiguity about longevity: You don't know if you'll live to 85 or 95. This uncertainty creates paralysis: "What if I spend too much and run out?" The fear of outliving money prevents spending money at all.

Responsibility to heirs: Many retirees feel obligation to leave inheritance—even when adult children are financially comfortable and would prefer parents enjoy their money. The guilt of "spending my kids' inheritance" prevents spending at all.

These fears aren't irrational. They're based on real risks. But they often become disproportionate, preventing spending that would significantly improve life quality with minimal actual risk to financial security.

Spending Requires Confidence in Your Plan

You can't give yourself permission to spend if you're uncertain whether your plan actually works. Remove that uncertainty.

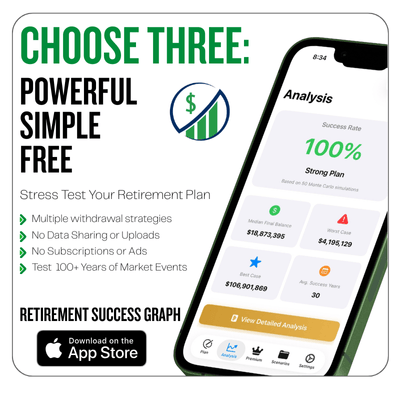

Retirement Success Graph stress-tests your retirement plan using Monte Carlo modeling—the same statistical approach institutional investors use. See the actual probability your portfolio lasts through different spending levels, withdrawal rates, and market conditions.

The free version runs 50 simultaneous simulations showing success probability through age 95. Upgrade once for $4.99 to run 10,000 projections, model different spending scenarios, and compare withdrawal strategies.

Your data stays private on your device—no subscriptions, no ads. Download from the App Store and gain the confidence to spend strategically.

Strategic Spending vs. Frivolous Spending

Not all spending deserves equal consideration. The key is distinguishing strategic from frivolous:

Strategic spending:

- Aligns with stated values and priorities

- Creates lasting experiences, memories, or capabilities

- Enhances relationships or life quality

- Would generate regret if delayed or avoided

- Serves the life you're trying to build

Frivolous spending:

- Serves impulse or status rather than genuine values

- Creates temporary pleasure without lasting impact

- Competes with or undermines stated priorities

- Wouldn't generate regret if avoided

- Serves the life others expect rather than what you want

The test: Will you remember or value this expenditure in five years? If yes, probably strategic. If no, probably frivolous.

Examples:

Strategic: $8,000 trip to visit grandchildren across country. Creates irreplaceable memories and serves family connection value.

Frivolous: $8,000 luxury handbag that's objectively beautiful but doesn't align with any stated value and will sit in closet.

Strategic: $15,000 to take course or certification in area of genuine interest that opens new capabilities.

Frivolous: $15,000 impulse boat purchase because "I'm retired, I should have a boat" despite never expressing interest in boating.

The dollar amounts are identical. The strategic value is completely different.

Research from the Financial Planning Association on retirement spending strategies shows that retirees who spend more on experiences (travel, education, social gatherings) and less on possessions (cars, clothes, luxury goods) report higher satisfaction—suggesting that categories of spending matter more than absolute amounts.

The 1% Rule: Spending Your Portfolio

If portfolio guilt prevents spending, establish a clear framework that feels safe:

The 1% Rule: Your portfolio can decline by 1% annually and still likely succeed through 30+ years. That means if you have $2 million, your portfolio can drop to $1.98 million—a $20,000 decrease—without materially impacting long-term success.

This $20,000 becomes your "guilt-free spending budget" beyond regular living expenses. Use it for:

- Experiences you've been postponing

- Generosity toward family or causes

- Quality-of-life improvements

- Strategic big purchases

The portfolio might not actually decline—market returns often offset withdrawals. But you have permission to let it decline by this amount without viewing it as failure.

This framework transforms your relationship with spending. Instead of "How little can I get away with spending?" the question becomes "How do I best deploy this $20,000 annual permission?"

The Widow/Widower Test

Imagine your spouse passes away (or if you're single, imagine you receive terminal diagnosis). How would your spending change?

Most people answer: "I'd be less careful about money. I'd take that trip. I'd upgrade that thing. I'd spend more freely on experiences."

The follow-up question: "So why are you waiting?"

The widow/widower test exposes how much spending hesitation isn't financial—it's psychological. You're denying yourself things you could afford and would regret not doing, based on fears that often won't materialize.

This isn't advocating recklessness. It's advocating strategic spending while both partners are alive to enjoy it, while you have health and energy, while opportunities still exist.

The Federal Reserve Bank studies on retirement spending and happiness show that spending on shared experiences early in retirement (when both partners have health and mobility) predicts higher lifetime satisfaction than deferring spending until later when capabilities may be limited.

Overcoming the "What If" Spiral

The primary driver of portfolio guilt is "what if" thinking:

- What if markets crash?

- What if I live to 100?

- What if healthcare costs explode?

- What if my kids need financial help?

- What if, what if, what if...

These fears are legitimate. They're also often paralyzing when they become the dominant framework for every spending decision.

Strategies to manage "what if" thinking:

Scenario planning: Instead of vague worry, model specific scenarios. "If markets crash 40% in year one of retirement, what happens to my plan?" [Tools like Retirement Success Graph make this trivial.] Often you discover your portfolio survives even worst-case scenarios—which provides permission to spend more freely in probable scenarios.

Emergency reserves: Maintain 2-3 years of expenses in cash/stable investments. This buffer protects against sequence-of-returns risk and provides psychological security enabling more confident spending from remaining portfolio.

Differentiate spending types: Regular living expenses need high confidence (90%+ success probability). Discretionary/luxury spending can accept more risk (70%+ success probability). You don't need the same certainty to justify upgrading airline seats as you need for paying rent.

Annual reassessment: Check portfolio health yearly. If you're on track, give yourself permission to spend. If falling behind projections, adjust. This prevents both overspending (by monitoring regularly) and underspending (by confirming when spending is safe).

The Legacy Trap

Many retirees restrict spending because they want to leave substantial inheritance to adult children. This sounds admirable. It's often misguided.

Questions to consider:

Do your kids actually need your money? If adult children are financially stable, your inheritance might be less impactful than you assume. They'd often prefer you enjoy your money while alive.

Are you sacrificing your life quality for theoretical future inheritance? Living in outdated home, denying yourself experiences, limiting life quality—all to maximize what you pass on. Your kids would probably prefer you live well.

Have you discussed expectations? Many retirees assume children expect inheritance. Many adult children assume parents will spend on themselves. Nobody talks explicitly. Result: parents sacrifice unnecessarily.

Would strategic spending now benefit everyone more? Helping with grandchildren's education while you're alive to see the impact. Funding family trips creating shared memories. Providing down payment help when kids actually need it rather than inheritance when they don't.

The AARP Public Policy Institute research on retirement planning shows that explicit family conversations about inheritance expectations often reveal misalignment—parents sacrificing more than children expect or want.

If leaving legacy matters to you, great—fund it explicitly and spend the rest freely. If it doesn't, give yourself permission to spend without guilt.

From Scarcity to Sufficiency

The money mindset shift retirement requires is from scarcity to sufficiency:

Scarcity mindset: Never enough. Always need more. Spending is losing. Accumulation is winning. The game never ends.

Sufficiency mindset: I have enough. My portfolio provides security. I can spend strategically on what matters without fear. The game is already won.

This doesn't mean spending recklessly. It means spending strategically without the psychological burden of guilt undermining every decision.

You built financial security to create freedom. If that security doesn't enable you to actually live differently—to take the trips, make the upgrades, enjoy the experiences—then what was the point?

The money you saved isn't the score. It's the tool. Use it.

Ready to explore the psychology of spending in retirement? Listen to Episode 11 of Casual Mondays: "Money Mindset Shift - From Accumulation to Strategic Spending" wherever you get your podcasts.

Need confidence that spending is safe? Download Retirement Success Graph to model different spending scenarios—free from the App Store.