Five Critical Steps to Future-Proof Your Retirement Plan in 2026

Your retirement plan needs more than the 4% rule. These five steps address what financial advisors won't tell you about early retirement in 2026.

You've run the numbers. Maybe you've even paid a financial advisor to double-check them. The spreadsheet says you can retire. The Monte Carlo simulation gives you an 87% success rate. Your 401(k) balance finally has seven figures.

So why does January 2026 feel less like liberation and more like standing at the edge of a cliff?

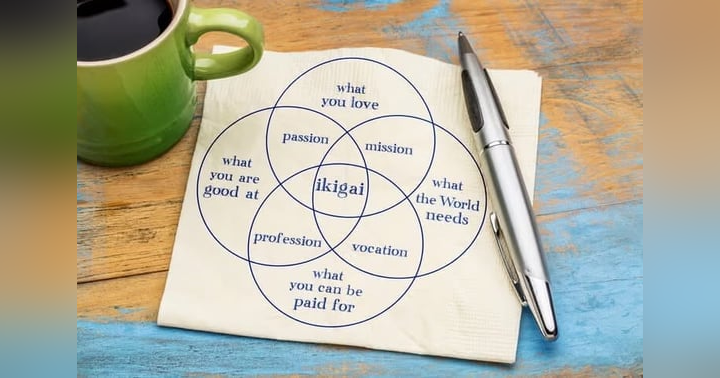

Because here's what nobody tells you: having enough money to retire is the easy part. Figuring out what to do with 30 or 40 years of unstructured time? That's the challenge that keeps early retirees up at night.

I spent 25 years in luxury hospitality before retiring in my early 50s. The financial transition was smooth. The psychological one? That blindsided me. After interviewing dozens of early retirees for the Casual Mondays Podcast and synthesizing research from Stanford's Center on Longevity, MIT's AgeLab, and the University of Michigan's Health and Retirement Study, I've identified five critical steps that separate retirees who thrive from those who drift.

Step 1: Stress-Test Your Retirement Plan Against Reality, Not Theory

The 4% rule was created in 1994 based on 30-year retirement periods. If you're retiring at 45, 50, or even 55, you're looking at 40-50 years of withdrawals. The math changes dramatically.

Here's what changed in your retirement plan between December 2025 and today: probably nothing. But here's what should have changed: your understanding of sequence-of-returns risk, inflation sensitivity, and longevity assumptions.

Most retirement plans assume you'll spend the same amount every year, adjusted for inflation. Reality looks different. Healthcare costs spike in your 70s and 80s. Travel spending peaks in your 60s then declines. Long-term care can obliterate even conservative projections.

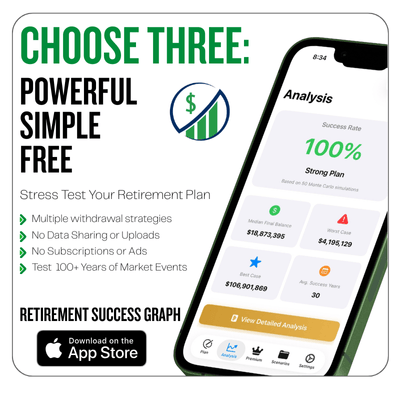

Action step: Use Monte Carlo modeling that accounts for variable spending patterns, not linear projections. The Retirement Success Graph app stress-tests your plan against 100 years of actual U.S. market data, showing you where your plan succeeds and—more importantly—where it fails. This isn't pessimism; it's preparation.

Step 2: Design Your Post-Career Identity Before You Need One

Tom was a senior vice president overseeing 2,400 people across three continents. Six days into retirement, he had a panic attack at a neighbor's barbecue when someone asked, "What do you do?"

For 34 years, Tom had known exactly how to answer that question. Now? Nothing.

Financial advisors focus on your net worth. Nobody focuses on your sense of worth. That's the gap that creates the identity crisis 60% of early retirees experience in their first year, according to research from the American Psychological Association.

Your business card told people who you were. Without it, you're writing a new story from scratch. That's both terrifying and liberating.

Action step: Before your last day of work, complete this sentence in writing: "Five years from now, when someone asks what I do, I'll say..." Write the full answer. Not your old title. Your new identity. Then work backward to figure out what daily actions get you there. (We dive deep into this in Episode 1: The Identity Shift—it's worth the 25 minutes.)

Step 3: Build Structure That Doesn't Replicate Work's Rigidity

The first month of retirement feels glorious. Sleep until 9 AM. Read for three hours. Take your spouse to lunch on a Wednesday because you can.

Then month two hits. The novelty evaporates. You're scrolling your phone at 10:47 AM in yesterday's clothes, wondering why freedom feels more like vertigo.

Here's what I learned the hard way: structure isn't the enemy of retirement. Work's structure was the enemy. You don't need a 60-hour workweek. You need anchor commitments that create rhythm without rigidity.

Research from Harvard Business School shows that retirees with 3-5 "anchor commitments"—recurring activities that give shape to their week—report 40% higher life satisfaction than those without them. These aren't obligations. They're agreements with yourself about how you want to spend your time.

Action step: Identify three anchor commitments for 2026. One physical (e.g., "Tuesday and Thursday morning gym sessions"), one social (e.g., "Wednesday volunteer shift at the food bank"), one intellectual (e.g., "Friday morning Italian lessons via Zoom"). Put them on your calendar before anything else fills the space. Structure enables freedom; it doesn't constrain it.

Step 4: Shift From Accumulation Mindset to Strategic Deployment

You spent 40 years saving 10-15% of every paycheck. Living below your means. Delaying gratification. Not touching the principal.

Those voices got you TO retirement. Now they're preventing you from enjoying it.

University of Pennsylvania researchers call this "portfolio guilt"—the feeling that spending retirement savings is wrong, even though that's literally what they're for. The average retiree spends 70-80% of what they could sustainably afford. The other 20-30%? Left on the table out of fear.

Your 85-year-old self doesn't care about your net worth. They care about whether you took the trip to New Zealand. Visited your grandkids more often. Upgraded to the better seats because you could.

Action step: Create three spending buckets for 2026. Bucket 1 (50-60%): Baseline necessities. Bucket 2 (25-35%): Quality-of-life upgrades aligned with your values. Bucket 3 (10-15%): Pure joy—no justification required. Give yourself permission to spend from all three buckets without checking your portfolio balance afterward. (Episode 14: Money Mindset Shift unpacks this framework in detail.)

Step 5: Measure Time Wealth, Not Just Net Worth

You know your net worth to the dollar. When's the last time you calculated your time wealth?

If you retire at 52 with a 30-year life expectancy, you have approximately 175,200 waking hours remaining. That's your time portfolio. The question isn't whether you have enough money. The question is: are you investing those hours in activities that compound meaning?

MIT AgeLab research shows that retirees who track "meaningful hour allocation" report 35% higher life satisfaction than those who simply let days happen. Not every hour needs to be meaningful—that's exhausting. But you should know where your time is actually going versus where you want it to go.

Action step: For the next seven days, track your time in 30-minute blocks. At the end of each day, mark each block: Energizing, Neutral, or Draining. By day seven, you'll see patterns. Double down on the energizing activities. Eliminate or delegate the draining ones. This is time wealth—being intentional about your most finite resource.

The Step Nobody Takes: Sharing Your Plan

Here's the bonus step that separates people who implement these strategies from those who bookmark them and forget: tell someone.

Not for approval. For accountability. Research from the American Society on Aging shows that retirees who share their plans with another person are 70% more likely to follow through versus those who keep them private.

Find someone—a spouse, friend, fellow early retiree—and walk them through your answers to steps 1-5. Put a follow-up conversation on the calendar for March 2026. That simple act of external accountability increases implementation rates exponentially.

Your Retirement Plan Is a Living Document

Financial advisors treat retirement plans like static documents. Update every three years. Rebalance annually. Check the boxes.

But retirement isn't a financial event. It's a life transition that unfolds over decades. Your plan from 2025 shouldn't look identical to your plan in 2026, 2027, or 2030. It should evolve as you evolve.

These five steps aren't "set it and forget it" actions. They're frameworks for making better decisions as life surprises you—because it will. Markets will crash and recover. Healthcare costs will spike. You'll discover interests you didn't know you had and abandon hobbies you thought would last forever.

The goal isn't perfection. It's thoughtful adaptation.

If you're feeling overwhelmed by any of this, you're not alone. Every guest on the Casual Mondays Podcast started where you are: uncertain, slightly anxious, wondering if they'd made the right decision. The difference between people who thrive in early retirement and those who drift isn't luck. It's willingness to treat retirement as something you design, not something that just happens to you.

Welcome to 2026. Let's make it count.

The Casual Mondays Podcast explores the daily realities of early retirement—the challenges, transitions, and frameworks that help retirees build meaningful lives beyond their careers. New episodes every Monday at www.casualmondayspodcast.com.